If you're struggling to make ends meet while your following paycheck arrives, you have a few choices. Reaching out to loved ones might be the answer for some. Others get by taking up part-time or temporary work or by using credit to cover their expenses. There is also the option of using cash advance applications to borrow smaller sums of money and repay them when you are paid again. One of the best-known applications like this is Earnin, which provides instant cash loans. This software does not rely on interest or fees, instead making money from tips. But before taking out a loan, you should familiarize yourself with the app's features and drawbacks. All of this and more are discussed in our comprehensive review of the earnin app.

About Earnin

Earnin is a firm that offers a variety of financial services, one of which is the provision of its customers with simple and hassle-free cash loans on the basis of their earned salaries. Earnin offers loans up to $550 every pay period in case you find yourself in a tight circumstance and need access to funds before you get your regular salary. After launching in 2014, the firm has attracted more than 2.5 million daily users. One of the most downloaded financial applications of all time, it can be used on either Android or iOS.

Earnin Characteristics

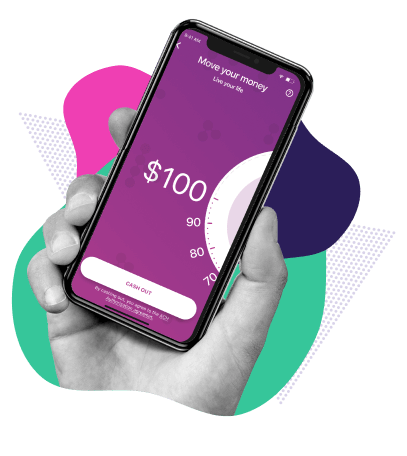

Earnin Cash Out

If you use Earnin's cash-out service, you may get your earnings immediately. You may borrow up to $500 in between paychecks but no more than $100 every day. In order to get your cash advance, the app will need to link to the bank and transfer the funds directly into your account. Earnin will deduct the money you owe from your next paycheck. Advances on your Earnin balance do not incur any interest charges or other hidden expenses. There is no need to worry about your credit score, and you may withdraw up to $100 in the first pay month. You may borrow up to $500 every pay period if you've established a good repayment history with Earnin.

Max Boosts

If you find yourself in need of extra cash throughout a pay cycle, you may acquire a Max Boost, a momentary $50 cash loan boost, to help carry you through until your next payday. The Earnin method is social in nature since you must have a mutual buddy vouch for you via the app. Simply ask a buddy to approve your desire for a Max Boost & Earnin will automatically spot you some more cash. An increase of more than $500 each pay period is not possible with Max Boosts.

Balance Shield

If you're short on funds until you are paid again, a cash advance from Earnin could be the way to go. However, the Balance Shield function may also protect you from having to pay expensive overdraft fees at your bank. Users may tell Earnin to send them a notification when their balance falls below a certain value. If the amount in your connected checking account falls below $200, for instance, Earnin may send you a notification. Balance Shield overdraft protection cash withdrawals may be set up automatically and function similarly to the standard $100 daily cash withdrawal limit. For more information, contact earnin app customer service.

Earnin Express

Through Earnin Express, customers may be paid two days early. It also raises the maximum cash withdrawal amount from $1,000 to 80 percent of your salary. With a cash withdrawal, your funds will be sent to your account as quickly as feasible. Your earnings will be sent to an Earnin account so that you may track them there. It won't affect when you are paid, but you may be able to obtain your money a day or two sooner. Earnin Express is available at no extra cost. However, service gratuities are still expected and may be paid in cash.

How Can I Reach Earnin'?

You may reach Earnin's helpful staff anytime by utilizing the app's built-in chat feature or by writing a direct message (DM) on Instagram or Twitter. However, there are over 180,100 reviews of the application on the Play store, with an average rating of 4.4 stars. Users like Earnin's no-fee structure and how it bridges the gap between paychecks. However, some customers have complained about the length of time it takes for help to respond and numerous disconnections between the application and their bank accounts.

Is Earning Safe and Legal?

Earnin claims on its website that protecting your privacy is a key concern and that it would never sell your data. Earnin also does not request or affect your credit rating or social security number. Only when signing up for Earnin Express, will you be asked for your Social Security number; otherwise, the program requires very few personal details. Earnin claims that their system utilizes encryption to ensure the security of user information and funds.

Bottom Line

The demand for services provided by businesses like Earnin has increased dramatically in recent years. When weighed against other choices, such as payday loans, a number of such cash advance applications are preferable. But you should still avoid taking on too much debt. You shouldn't utilize a cash advance app that looks at your next paycheck as collateral casually since it's still a loan. Tips and other extras may rapidly add up, so it's best to avoid them if possible. We hope that this earnin app review is really helpful.