Do you need to complete a new W-4 form even if you hadn't changed positions simply because the current form could be different from the one you filled out when you first started working for your employer? If you haven't moved jobs, the answer is no. The Internal Revenue Service (IRS) said that it altered the form to boost the openness of its payroll withholding system and increase its accuracy. If you haven't moved employment and there's no cause for you to revise your W-4, you won't need to fill out a new one, which is a relief if you haven't. Your employer is free to keep using the one they have on file for you.

On the updated version of Form W-4, workers are not prompted to specify personal exemptions or exemptions for dependents, as these categories are no longer applicable. However, it does inquire how many dependents you can claim on your tax return. It will also ask you whether you want to raise or reduce the amount of money being withheld from your paycheck depending on specific variables, such as having a second job or being eligible for itemized deductions.

Even if you don't have any extenuating circumstances, it's still a good idea to utilize Form W-4 strategically so that you either don't owe any taxes or get a refund when you complete your federal tax return for the year. This applies whether or not you have unusual circumstances. This article will assist you in determining whether or not the W-4 form that is currently on file at your place of employment needs to be updated, as well as how to update the form if you feel that doing so would be beneficial. You must fill out the new form if you have new employment. This goes without saying.

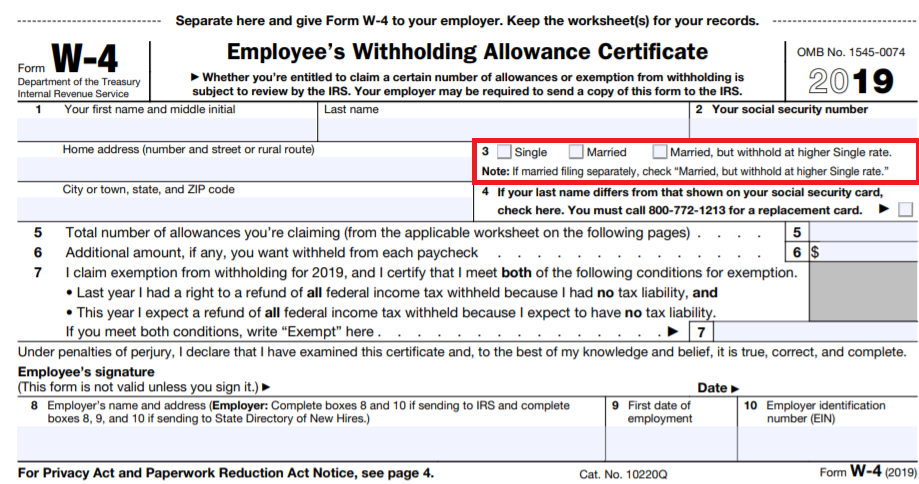

The Most Recent Version of Form W-4

The W-4 form underwent a comprehensive redesign in 2020, and as a result, fewer lines need to be filled out. The Employee's Withholding Certificate (Form W-4), which you fill out, determines the amount of tax that will be withheld from each paycheck you get from your employer. The Internal Revenue Service (IRS) receives the money that your employer withholds from your paycheck. This information, with your name and Social Security number, is sent to the IRS (SSN). When you submit your year-end tax return, you will compute your yearly income tax bill, and your withholding will be used to pay that amount. Because of this, the W-4 asks for identifying information such as your name, address, and Social Security number (SSN).

New Requirements for Form W-4

If you claimed a higher number of allowances, your employer would deduct a smaller amount from your paycheck; on the other hand, if you claimed a lower number of allowances, your company would deduct a larger amount. In the past, allowances had a tenuous connection to the personal and dependent exemptions that taxpayers claimed on their tax returns. Following that, as a consequence of the Tax Cuts and Jobs Act (TCJA) of 2017, the standard deduction was increased to the amount it is now by a factor of 2, while the personal and dependent exemptions were removed.

The 5 Steps in Completing the New W-4 Form

The new W-4 form comprises five distinct sections. Only steps 1 and 5 are necessary for all employees to complete:

- Step 1: is to provide your standard personal information, which identifies you and specifies whether you want to file your taxes as a single individual, as a married individual, or as a head of household.

- Step 2: This section is for taxpayers whose individual circumstances suggest that they should withhold a different amount than the normal amount. A second job, money from freelancing, or income from a spouse are all examples of things that might be noted in this section.

- Step 3: In this part, you will mention the number of children and other people financially dependent on you.

- Step 4 allows you to provide further justifications for increasing or decreasing the amount of money withheld from your paycheck. For instance, if you have assets that bring in passive income, this might cause your yearly income and the amount of taxes you owe to grow. You may be able to reduce the amount of taxes that you owe by itemizing your deductions. These are possible justifications for changing your withholding amount on the W-4.

- Step 5: Reasons why you might consider changing your W-4 form. When the new W-4 was made available for the tax year 2020, it was the first significant update to the form since the Tax Cuts and Jobs Act (TCJA) was passed into law in December of 2017. The withholding process for workers was significantly altered due to these new laws.